XAUUSD 16-03-2018 Intra-day analysis

USD strengthens as focus turns to next week’s Fed meeting

Daily Forex Market Preview, 16/03/2018

The U.S. dollar was seen posting some modest gains yesterday with investors positioning themselves ahead of the FOMC meeting next week. Expectations of an interest rate hike stands close to 90% for next week’s Fed meeting.

On the economic front, the Swiss National Bank held its monetary policy meeting yesterday. The central bank maintained the three-month LIBOR rate at -0.75% and did not offer any new signals for the market as far as the Swiss monetary policy was concerned. The Norges Bank also held its meeting yesterday with interest rates left unchanged. However, the Norwegian central bank signaled that interest rates could rise by September this year.

Looking ahead, the Eurozone final inflation estimates will be coming out later today. Economists’ forecasts point to subdued pace of increase in consumer prices. In the U.S. the building permits and housing starts data will be coming out followed by the industrial production figures.

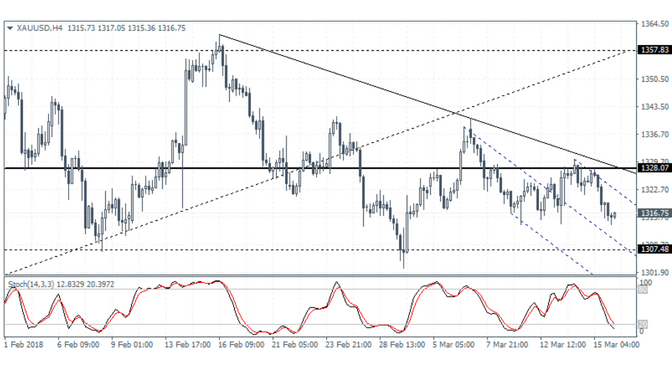

XAUUSD 16-03-2018 Intra-day analysis

XAUUSD (1316.75): Gold prices were seen retreating off the 1328 level with price action currently biased to the downside. Support at 1307 could be tested in the near term if the downside momentum continues. We expect to see gold prices potentially holding the declines at this support level and could move into a sideways range into next week’s FOMC meeting. A break below 1307 could extend the declines towards the round number support at 1300.00.