Fed hikes rates by 25 bps as expected in a balanced meeting

The U.S. Federal Reserve hiked interest rates by 25 basis points at its meeting yesterday as widely expected. This was the second rate hike in less than three months and the third increase since the central bank started its monetary policy tightening cycle in December 2015.

The U.S. short-term interest rates are now at 0.75% – 1.00%. The vote to hike rates was not unanimous, however, as Neel Kashkari, Minneapolis Fed President voted “no.” He was the sole dissenter at yesterday’s rate hike meeting.

The central bank, however, noted that core inflation which strips the volatile food and energy prices were still running below 2% and noted that the inflation goals were “symmetric” inferring that the central bank will tolerate inflation above 2% and that the overshoot in the inflation target won’t be persistent.

“The communication that the 2% inflation target is less of a ceiling than an objective is positive,” said Steven Friedman, a senior economist at BNP Paribas Investment Partners.

The markets were expecting to see a more hawkish statement from the central bank, but expectations had to be scaled back. For starters, the Fed’s “dot plot” which shows the expectations of each of the Federal Reserve members was little changed from December’s projections.

The central bank maintained that there was a firming in business investment and the central bank’s measure of inflation, Core PCE index was running close to the 2% target.

Thus, the Fed maintained its view that the markets can expect two more rate hike this year, as originally conveyed from the December 2016 meeting and economic forecasts. Although still too early, the markets are expecting the Fed to deliver the next rate two rate hikes in June and December respectively.

On the economic growth, the Fed did not make any major changes. The central bank expects inflation at 1.9% in 2017 with the longer-run economic growth seen at 2.0%. Meanwhile, on the GDP growth, the central bank forecasts a 2.1% increase in 2017 and 2.1% increase in 2018 with the longer-run estimates at 1.8%.

“It is important for the public to understand that we’re getting closer to reaching our objectives,” Fed Chair Janet Yellen said during the press conference.

Market Reaction to FOMC: U.S. dollar falls to a one-month low

Following the FOMC meeting yesterday, the U.S. dollar fell to a fresh one-month low at 100.32, closing the day at 100.36. The declines came despite a rate hike that was once again well communicated.

In the press conference, the Fed chair Janet Yellen said that the rate hike shouldn’t have come as a surprise to anyone given the Fed’s communication on the hike. “When I look at our sequence of communications, they seem to me to have been reasonably consistent over this entire period,” Ms. Yellen told reporters

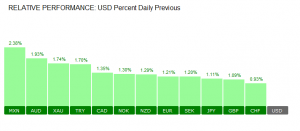

The biggest winner from yesterday’s FOMC event was, of course, the Mexican peso which rallied 2.38% on the day, lifted by a weaker greenback and also some positive comments on trade relations pertaining to Mexico.

The Australian dollar and gold were the other two big winners from yesterday’s FOMC meeting. Gold prices had earlier slipped to the support level at $1200 but managed to post a strong rebound off this level.

Ahead of the FOMC meeting, retail sales figures showed a 0.1% increase in February which was a moderate pace of increase following January’s 0.6%, data from the Commerce department showed. The slower pace of retail sales was however attributed to the delay in most Americans receiving tax refunds, leading to lower spending.

Inflation data was also published earlier, and data showed that consumer prices rose 0.1% in the month of February compared to the previous month. The CPI data was disappointing as it was the slowest one-month gain in inflation since 2016. However, on a yearly basis, inflation was seen rising 2.7%.

![Credit Card 160×600 [EN]](https://assets.iorbex.com/blog/wp-content/uploads/2023/06/13144507/Blog-Banner_EN-Banner_160X600X2.webp)