How to Trade Natural Gas Futures: Basics & Trading specifications

Among the various contracts available in the energy futures markets, there is no doubt that Oil futures are the most popular. However, Natural Gas futures also hold on its own offering a different flair and bringing its own uniqueness.

Orbex.com offers a selection of various energy futures contracts of which, Natural gas futures are one of the available futures contracts for trading. This brief guide gives you all the details on trading the Natural gas futures contracts with Orbex.com.

For the purpose of clarity, the Natural gas referred to in this article is the Henry Hub natural gas futures, quoted in US dollars traded on NYMEX and ICE exchange.

Natural gas – Basics

Natural gas or NG for short is a widely used commodity across both the US and Europe. The main purpose of Natural gas is in heating (both industrial and domestic) and power generation. Natural gas is a fossil fuel and is naturally occurring with Methane gas being the primary component and also includes Carbon Dioxide and Nitrogen. Natural gas is a byproduct of Oil.

Factors affecting Natural gas prices

As with any commodity, it is the supply and demand that determines the price of Natural gas. On the supply side, the main factors affecting Natural gas are:

- Change in the Natural gas production

- Volume of imports and exports

- Amount of natural gas held in storage facilities

On the demand side, the factors affecting natural gas are:

- Seasonal patterns (winter and summer months)

- Price of competing fuels

- Level of economic growth that fuels demand for Natural Gas

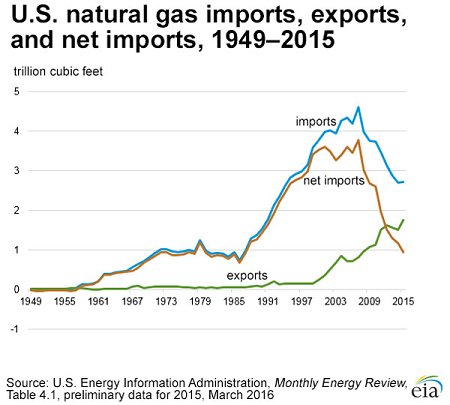

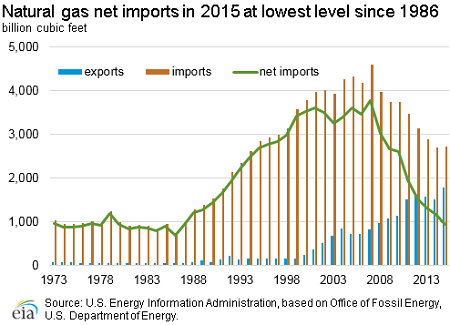

The US natural gas Imports and Exports

The US is a net importer of natural gas. According to the Energy Information Administration (EIA), in 2015 the US imported about 2.72 trillion cubic feet of natural gas while exporting 1.78 Tcf, leading to a net import of 0.93 Tcf. Of this, 3% accounted for consumption. Of the imports, the US relies on pipelines for delivery, which accounts for over 93%, while shipping makes for 7% in the form of Liquefied natural gas.

Biggest exporters of natural gas to the US

Canada and Mexico are two of the biggest exporters of natural gas to the US, with Canada taking the major share while Mexico accounts for less than 1% of pipeline imports.

Domestically, Texas, Pennsylvania, Louisiana, Oklahoma, and Wyoming are the five biggest states supplying 67% of the total US natural gas production (as of 2013). However, since 2007 the US net imports have been gradually declining due to increase in domestic natural gas production with 2015 showing a 5% increase in domestic production.

Economic reports affecting Natural gas prices in the short term

Natural gas prices are affected by economic reports. Of these, the most important reports to watch for are:

- Weather patterns/disruptions, seasonality: Weather disruptions such as hurricanes can affect the supply of natural gas especially if pipelines are in the line of sight. Besides the weather, seasonality also plays a bigger role. Obviously, winter months see’s higher demand for NG than summer months

- Industrial sector: The industrial sector which is a major consumer of natural gas also plays an important role on the demand side. Robust growth in the industrial sector often sees’s increased demand for NG

- Storage or inventories: Similar to crude oil, natural gas is stored as LNG, and the weekly inventory report can offer short term trading opportunities

- Competition with other fuels (coal, petroleum): Large industries often have the capability to switch between one form of fuel to another for power generation or other purposes. When the cost of other fuels falls, demand for natural gas decreases, leading to lower prices and similarly when the cost of competing fuels increase relative to natural gas, the demand for natural gas increases. Competing fuels include coal and petroleum

Natural gas – Trading specifications

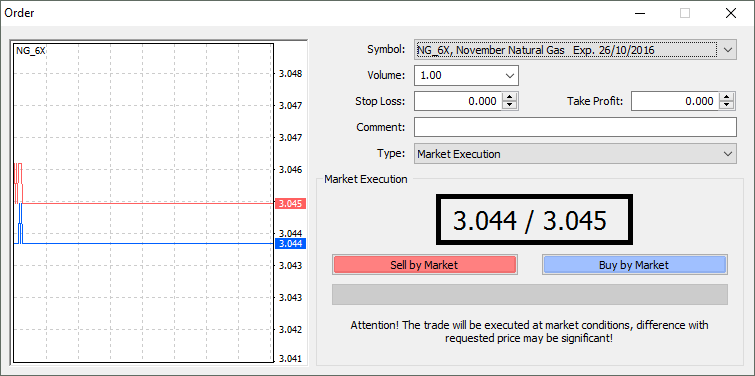

Natural gas is denoted by its ticker symbol NG followed by the year and the contract expiry month. For example, NG6X refers to a natural gas futures contract for 2016 with the expiry month X.

NG is priced in 3 decimals at Orbex.com or dollars and cents, per mmBtu or MBTU which stands for one million British Thermal Units or a thousand BTU’s. Therefore an NG quote of NG_6X 3.044 / 3.045 refers to the selling or buying price for the natural gas futures contract.

The standard contract size for Natural gas is 1 lot or 10,000 units with a tick value of $10 and a tick size of 0.001 and require an initial margin of 1000.

Therefore, if you were to trade 1 standard lot of NG futures, a 0.010 move in price is equal to $100. There is also an additional cost of $15 per standard lot as commissions when trading NG futures. You can, however, trade for a smaller contract size of 0.01 lots which is 100 units. In this case, the minimum price per tick is $1.

The NG contract comes with an expiration (close only) date. All open trades are automatically closed at 21:30 (GMT+2) on the contract expiration date.