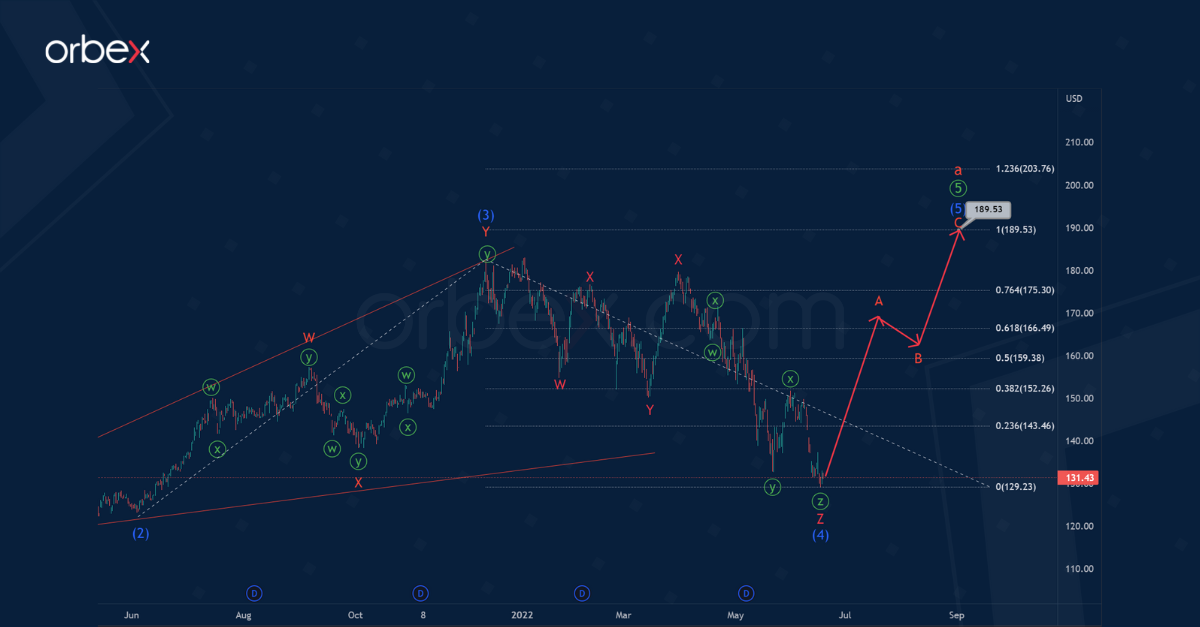

AAPL Cycle Impulse Moves Above Previous Maximum

The internal structure of AAPL shares hints at the development of the primary fifth wave. This takes the form of an ending diagonal (1)-(2)-(3)-(4)-(5) of the intermediate degree. Wave ⑤ is the final wave in the cycle impulse a.

Most likely, the intermediate correction (4) in the form of a minor triple zigzag W-X-Y-X-Z has ended.

In the near future, prices could begin to move higher in the intermediate wave (5). Wave (5) will take the form of a standard zigzag A-B-C.

It is possible that wave (5) will go to the level of 189.53. This is where wave (5) will be at 100% of intermediate wave (3).

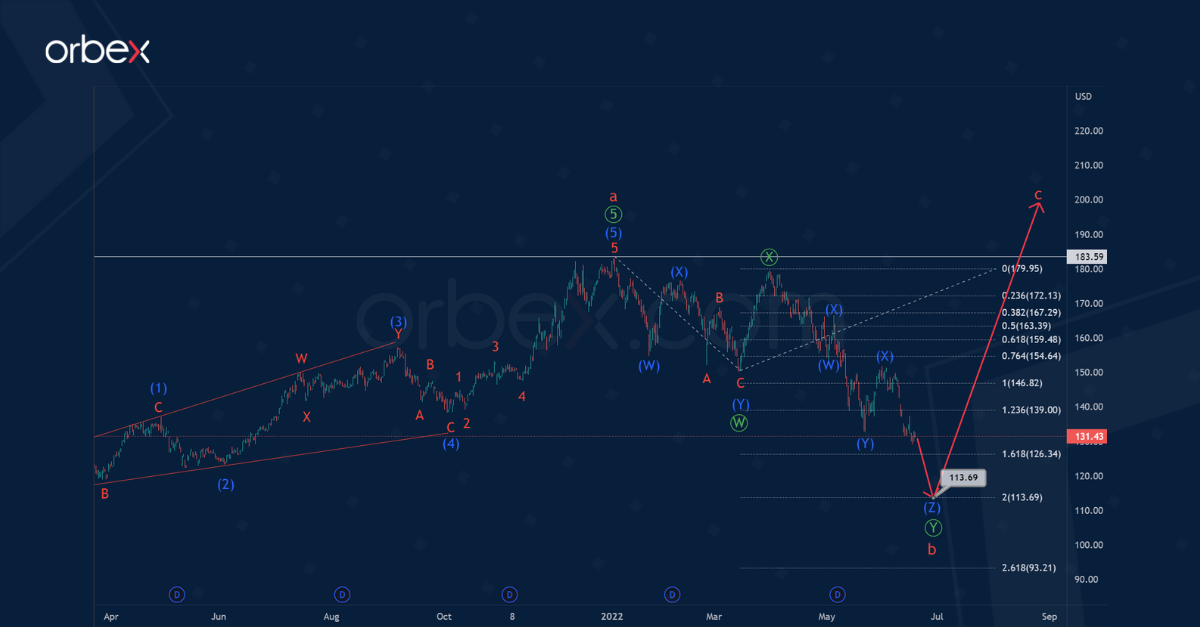

An alternative option shows a situation where the diagonal is fully completed, and with it the entire cycle wave a has ended.

Accordingly, at the time of writing the review, we see a drop in the cycle correction b. This can take the form of a double zigzag Ⓦ-Ⓧ-Ⓨ of the primary degree. It seems that the first two primary sub-waves Ⓦ-Ⓧ have already ended.

There is a high probability that the final sub-wave Ⓨ will move prices to 113.69. At that level, primary wave Ⓨ will be at 200% of wave Ⓦ.

After the cycle correction comes to an end, we can expect a bullish trend within the cycle wave c above the maximum of 183.59.

![Credit Card 160×600 [EN]](https://assets.iorbex.com/blog/wp-content/uploads/2023/06/13144507/Blog-Banner_EN-Banner_160X600X2.webp)