XAUUSD 28-03-2018 Intra-day analysis.

USD rebounds off monthly lows. Q4 2017 GDP expected to be revised higher

Daily Forex Market Preview, 28/03/2018

The U.S. dollar was seen attempting to post a modest rebound on the day on Tuesday. The U.S. dollar index pulled back from the fresh monthly lows posted earlier on Monday. Economic data was sparse but the Richmond Fed manufacturing index report showed a decline in activity.

The Richmond Fed manufacturing index rose at a slower pace in March with new orders and employment indexes falling. The composite index slipped to 15, down from 28 in February. However, most of the firms surveyed were optimistic over the next six months.

The Conference Board’s consumer confidence index was also coming out weaker in March after rising to an 18-month high in February. For March, the consumer confidence index fell to 127.7 compared to 130.0 in February.

Data from the Eurozone covered the flash inflation estimates for Spain. Consumer prices were seen rising at a slower pace of 1.2% on the year ending March which was weaker than the estimates of 1.5%.

For the day ahead, the economic calendar will see the release of the housing price index from Nationwide for the UK. In the NY trading session, the final revised GDP for the fourth quarter of 2017 is forecast to show a revised print of 2.7%, slightly accelerating from 2.5% previously reported in the second estimate. Pending home sales data is expected to show a modest recovery, rising 0.5 million and reversing part of the declines from the previous month.

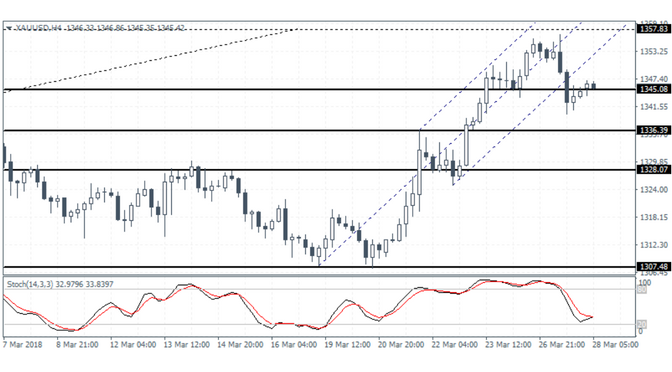

XAUUSD 28-03-2018 Intra-day analysis

XAUUSD (1345.08): Gold prices fell sharply on the day and erased the gains from Monday with the daily candlestick closing with a bearish engulfing pattern. This could potentially suggest some near term declines in price. The failure to clear the 1345 handle could push gold prices lower to test the 1336 level of support initially followed by a decline toward the 1328 region.