XAUUSD 27-03-2018 Intra-day analysis.

USD posts strong declines. Euro, GBP jumps on rate hike expectations

Daily Forex Market Preview, 27/03/2018

The U.S. dollar continued to extend declines on Monday as the U.S. dollar index was seen falling to fresh monthly low. The declines came amid a slow trading day. Economic data was sparse with only second tier data. The Dallas Fed manufacturing report showed that manufacturing production index fell to 12.7 compared to 27.9 in February. Business activity was also seen weaker with the index posting a print of 21.5 compared to February’s 37.2.

The euro and the Pound sterling posted strong gains as the market expectations on rate hikes strengthened. ECB member Weidmann spoke to reporters yesterday and came out hawkish on monetary policy. Weidmann is widely tipped to be the next ECB President.

Looking ahead, the economic calendar for the day will see the release of the flash inflation data from Spain. Headline consumer prices are forecast to rise 1.5% on the year, accelerating from 1.1% previously.

Later in the day, the Conference Board’s consumer confidence data for the U.S. Consumer confidence is forecast to rise to 131.2, up from 130.8 previously. If the actual data beats estimates, this could be another high in the U.S. consumer confidence as measured by the conference board.

The Richmond Fed will also be releasing the Richmond manufacturing index data. Economists forecast that manufacturing activity in the region slipped to 23 compared to 28 that was registered previously.

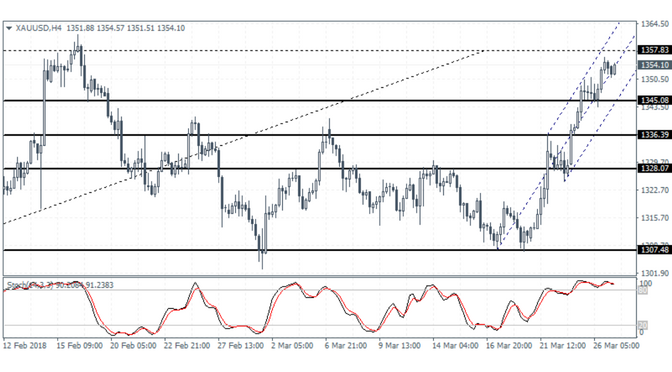

XAUUSD 27-03-2018 Intra-day analysis

XAUUSD (1354.10): Gold prices edged higher and look on track to test the 1357.83 level of resistance in the short term. The gains came amid rising concerns about the fallout from the U.S. imposing trade tariffs on goods from China. Following the brief dip back to 1328 last week, the currency pair pushed higher only to pause for a brief consolidation. We expect to see some downside in price action around the 1357 given that the precious metal has seen or established any significant support level in the near term. Watch for break below 1345 which could extend the declines lower to the 1336 level where support is likely to be formed.