Elliott wave analysis 16-03-18

Dollar Index (DXY) – Bearish Corrective Structure “winking” at 87.30

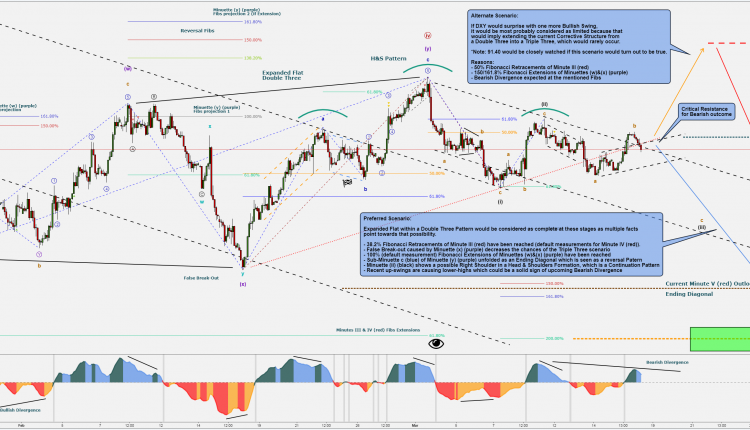

Dollar Index (DXY) current Wave Count and labeling of the Corrective Structure points towards a possible Double Three scenario, in which DXY could be poised for further weakness ahead.

The screen-shot below contains an in-depth view and multiple explained facts, from an Elliott Wave and technical standpoint.

DXY – 2H Chart as shown above.

During the current market conditions and uncertainty caused by Fundamentals, investors seem to be heading towards more of a safe-haven assets and currencies.

USD/JPY – 2H Chart:

USD/CHF – 2H Chart:

Many pips ahead!

RT

![Credit Card 160×600 [EN]](https://assets.iorbex.com/blog/wp-content/uploads/2023/06/13144507/Blog-Banner_EN-Banner_160X600X2.webp)