GBPUSD 22-02-2018 Intra-day analysis

USD edges higher on Fed minutes

Daily Forex Market Preview, 22/02/2018

The FOMC meeting minutes released yesterday sent the U.S. dollar to close higher on the day as investors brace for a March rate hike. Although the Fed minutes did not reveal anything new, the upbeat tone of the minutes saw the markets pricing three rate hikes this year, with the first rate hike expected as early as March.

Data from the UK showed that the unemployment rate increased to 4.4%. This was higher than the forecasts that indicated no change to the unemployment rate. However, the rise in the unemployment rate was offset by wage growth coming out stable at 2.5% on an annual basis.

In the Eurozone, the flash manufacturing and services PMI showed that economic activity in the bloc continued to rise but the momentum was seen declining after it touched a 12-year high in January.

Looking ahead, the economic calendar today will see investors focusing on the UK’s second revised GDP estimates for the fourth quarter of 2017. Data from ONS previously showed that the UK’s GDP grew at a pace of 0.5% during the quarter. No changes are expected at today’s revised GDP.

In the Eurozone, the ECB will be releasing the monetary policy meeting minutes from January. The ECB had kept interest rates and monetary policy unchanged at its meeting in January. However, investors will brace for any potential hawkish follow through from the minutes.

Later in the evening, the retail sales figures for the fourth quarter of 2017 will be coming out for New Zealand. Economists are optimistic that retail sales might have increased 1.4% on the quarter, accelerating from the 0.2% increase previously.

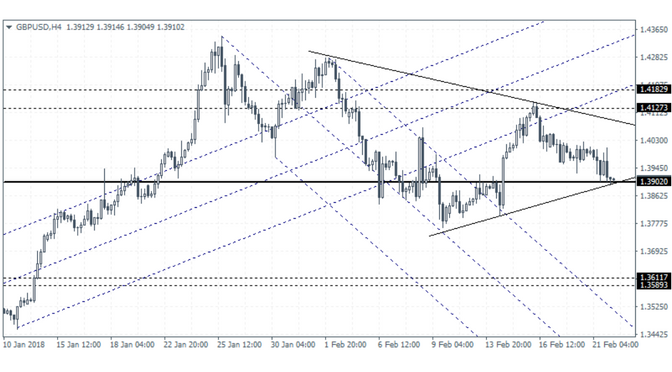

GBPUSD 22-02-2018 Intra-day analysis

GBPUSD (1.3910): The British pound was seen testing the support level at 1.3902 earlier today. The currency pair was seen falling after a disappointing labor market data and the FOMC minutes which sent the USD higher on the day. While price action could consolidate near the support level, in the event of a breakdown below this support, the declines could push GBPUSD down towards 1.3611 – 1.3589 level of support. Price action is also forming a triangle pattern and this could suggest some near term retracement to the upside. A breakout from the triangle pattern is required to establish further trend direction.