Gold continues to hold its range, looks to policy decisions from BoJ and FOMC next week

Gold bulls cannot afford to be complacent over the next few days as the Bank of Japan, and the FOMC monetary policy meetings will likely see the temporary lull in the precious metal giving way to strong price action. Price action continues to consolidate within the $1350 – $1300 price levels, and we suspect this pattern to play out until next week’s two big events. Near-term volatility could, however, keep prices choppy as investors await key economic releases such as retail sales and consumer price index releases in the remainder of this week.

After enjoying a stellar run, for the most part, this year, gold’s bullish momentum has faded since July. Blame it on the slow summer months, which typically see’s lower trading volumes or monetary policy inaction which has left investors clueless. Following the June’s Brexit referendum, July and August saw gold prices heading nowhere. But that could change, come next week. Peter Hug, director at Kitco Metals, sums it up aptly, saying, “This week almost feels like it’s still August. There’s no participation in the market, and all of a sudden, September might be on the table again. It’s just keeping the market on edge, and that’s why we’re getting this choppiness.”

While gold prices had posted a strong rally during the middle of last week, the precious metal failed to hold on the gains as prices fell promptly after retesting the $1350 price handle. Gold prices have been in a steady decline for the past five sessions, and the range is likely to be maintained.

Next week, on September 21, Wednesday, the Bank of Japan prepares for its monetary policy meeting. While the markets still remain clueless, there are underlying expectations building up that the BoJ could expand its monetary stimulus program as well as including cutting interest rates deeper into the negative territory. While this could be seen as a positive for gold, later in the day, the FOMC meeting will be decisive. Leaving policy unchanged at this meeting could keep gold prices supported with the potential to test the $1400 an ounce price level for the first time in three years.

Despite the bullish undertones, there is still a risk that gold prices could slip below the key $1300 psychological price level.

Gold – Technical Outlook

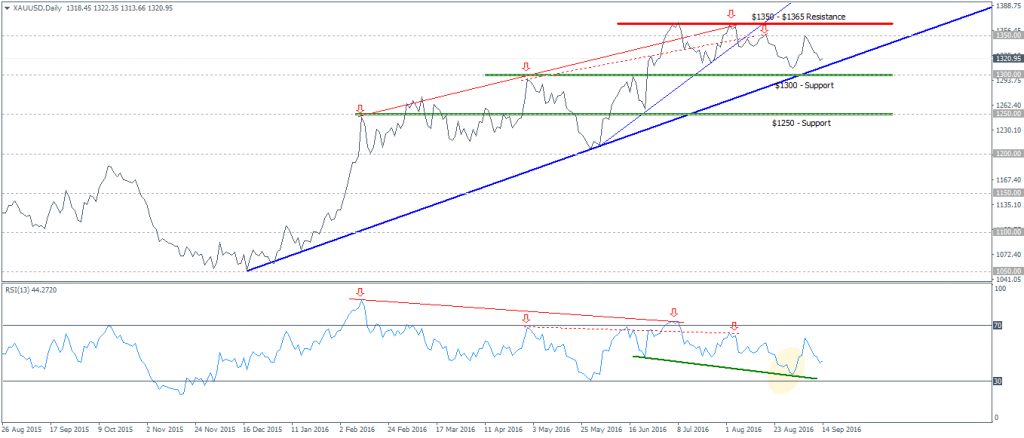

Looking at the daily chart for gold, we can see the range resistance and support being established near the 1350 – 1360 level and 1300 – 1310 support. It is quite clear that these key price levels could be breached only on a strong fundamental catalyst. The medium term outlook in gold shows an impending correction in prices to the downside, which could be confirmed on a break down below the 1300 support. In this case, we could expect gold prices to test the $1250 handle.

On closer observation, the consolidation on the daily chart is showing a descending triangle technical pattern in gold on the 4-hour time frame. Support is seen at 1320 – 1310 region with price making consistently lower highs. As long as the falling trend line is not breached, we could expect the price to be pressured to the downside.

The descending triangle pattern points to prices slipping towards the next main support at 1275 – 1265 region, which was briefly tested back in June this year.