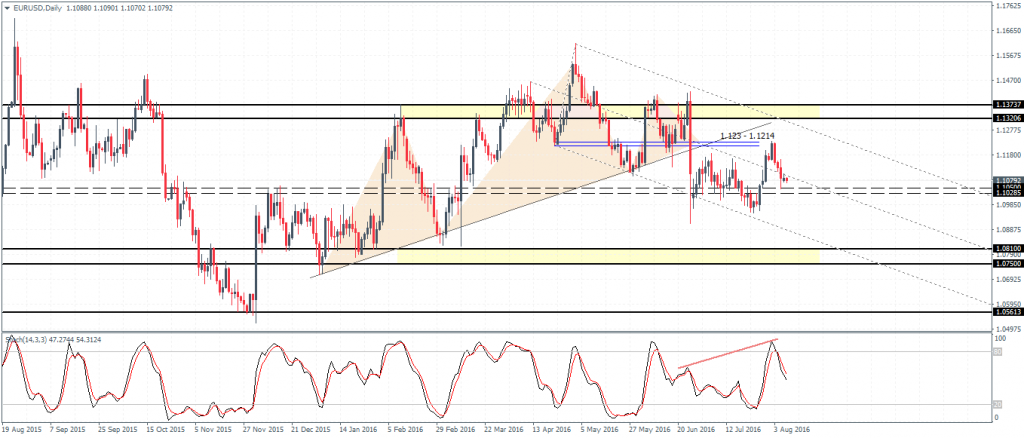

EURUSD trading flat, range bound within 1.10 and 1.12

EURUSD (1.1079) has been trading flat since mid-June with price seen bouncing off the 1.10 support and 1.120 resistance. Last week’s retest to 1.123 – 1.1214 marks a correction to the declines with prices re-establishing resistance near 1.123 – 1.1214 which previously served as support. A breakdown below 1.105 – 1.10285 is required for EURUSD to continue its declines to the downside. Support near 1.0810 – 1.075 remains the next likely target on a confirmed breakout.

USDJPY (102.36) has posted a higher low last week with price seen clearing the 101.5 level. Still, the support zone near 103.15 – 101.5 remains a key level that needs to be cleared to ascertain further upside in USDJPY. Resistance is seen at 105.6 – 106.20 which could be targeted to the upside. In the near term, USDJPY is likely to continue trading within the mentioned levels with the further directional bias being established on a breakout from either of the two levels mentioned. USDJPY is also in the process of forming a possible head and shoulders pattern with the left shoulder and the head being established near the 106.20 price level. Therefore, a reversal near this resistance level could see USDJPY slide back to 101.5 support and break down from this support could see prices declining further.

GBPUSD (1.2989) turned weaker after the BoE’s easing policies. However, the declines have been limited in nature with the price still seen trading above the previous lows formed near 1.28. Price action in GBPUSD shows the bearish pennant pattern currently with price breaking down below 1.312 indicating that further declines could see GBPUSD test the previous lows near 1.28. A break below 1.28 could extend the declines further with GBPUSD likely to resume its bearish trend thereafter. However, the Stochastics are showing a higher low which could signal a potential bullish divergence. Watch for any retracements to 1.312 off the 1.28 lows.

USDCAD (1.3179) has failed to break out convincingly above 1.3136 – 1.308 resistance level keeping prices moving sideways. However, the strong bullish candlestick formed on Friday is likely to see USDCAD remain biased to the upside. Resistance at 1.369 – 1.37 remains a key level to the upside as long as prices can remain support above 1.313 – 1.308. In the event of a breakdown, the rising trend line could be broken which could shift the bias to the downside. Support at 1.26 – 1.2525 remains a key level that could be tested.

USDCHF (0.983) reversed strongly after falling to 0.9662 from the rising wedge pattern. To the upside, the resistance at 0.9928 will need to be cleared to establish further gains. Major resistance is seen at 1.0150 which could be achieved if USDCHF breakout above 0.9928. Watch for any potential reversal near 0.9928 in which case; USDCHF could remain range bound with prices supported above 0.97740.