RBNZ Monetary Policy Preview – March 2016

The Reserve Bank of New Zealand is expected to hold rates steady at tomorrow’s meeting but could risk talking down the Kiwi’s exchange rate.

The Reserve Bank of New Zealand will be holding its monetary policy meeting on March 9th. Heading into the event, expectations are close to a broad consensus expecting the RBNZ to hold rates steady at 2.50%. However, the decision could be a close call with inflation in the fourth quarter of 2015 declining -0.50%, more than the expected -0.20% and down from 0.30% rise in inflation in the third quarter. The RBNZ’s inflation target range is between 1.0% and 2.0%.

Going solely by inflation, the RBNZ keeps a close watch on inflation expectations, which as of February’s release saw a decline from 1.90% to 1.60%. In the Bank’s last monetary policy meeting in January 2016, rates were held at 2.50%.

In the January monetary policy statement, the RBNZ noted that “there has been some easing in financial conditions, as the New Zealand dollar exchange rate and market interest rates have declined. A further depreciation in the exchange rate is appropriate given the ongoing weakness in export prices“

Since January 28th, 2016, the NZDUSD has appreciated strongly, gaining of 5.12% by last Friday’s (04/03) close at $0.681, erasing the previous period’s decline of -3.51% since the December 9th rate cut of 25bps. The Kiwi’s appreciation is likely to see the RBNZ come down strongly if the Central bank does manage to keep rates steady given that the main transmission mechanism for the rate cut to stimulate inflation is via a weaker New Zealand Dollar.

Looking ahead, the markets expect to see another rate cut by June 2016, bringing the OCR rate to 2.0% and there is speculation that another rate cut could be delivered by September 2016. However, for the moment, the RBNZ is likely to hold rates steady and try to talk down the Kiwi’s exchange rate while waiting for more economic data.

Next week, the fourth quarter GDP data will be released, which currently stands at 0.90% for the quarter and 2.30% on a year over year basis while the first quarter inflation data is due on April 18th ahead of the next RBNZ’s monetary policy meeting on April 28th. Between now and then, the RBNZ is likely to see enough data along with the forward guidance from Federal Reserve as well. Holding rates steady at this meeting is likely to see a rate cut by April or May especially if Q1 inflation deteriorates further.

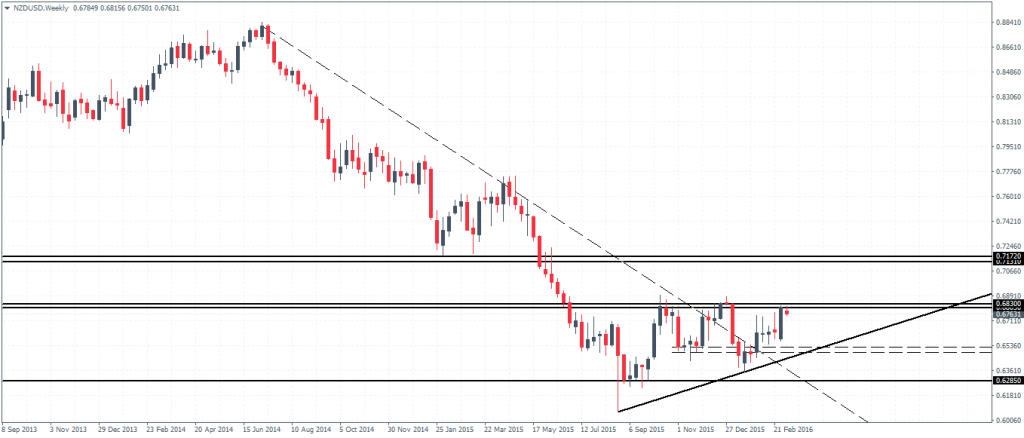

NZDUSD – Technical Outlook

The Kiwi closed out last week with strong gains and in the process formed a bullish engulfing candlestick pattern on the weekly chart. The rally was capped near a strong resistance level between 0.6805 and 0.6830. Of interest is the bullish ascending triangle pattern currently unfolding as prices have posted a higher low at 0.646 in the week of 11th January 2016. If the declines are capped near the trend line connecting August 31st lows at 0.6278 and the 11th January lows, a move to the upside could see the resistance level likely to be threatened. A successful break to the upside above 0.6805 – 0.6830 could see a minimum move to $0.7131 – $0.7172, which comes just below the 0.72/0.73 long term support that was broken.