The Week Ahead – End of tunnel

GBPUSD rallies over tightening prospect

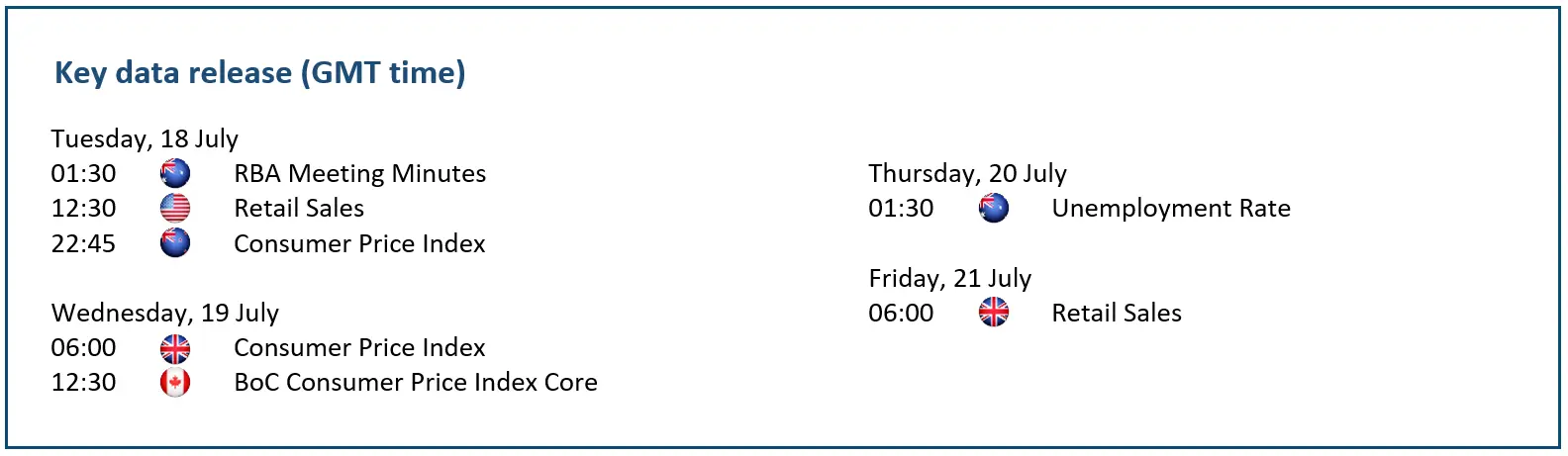

Cable rallies as the Bank of England has hands tied to keep raising interest rates. Despite a slight uptick in the unemployment rate in the UK, record high wage growth may keep the central bank in the hot seat as the UK grapples with an inflation rate that is running higher than in any other major economy. Governor Bailey’s vow to stick to the plan has convinced traders that a battery of hikes are coming with a peak up to 6.5%, the highest in 25 years, and a hot CPI would cement these expectations. Meanwhile, the dollar’s retreat would boost Sterling’s relative strength. 1.3300 is the threshold and 1.2700 the closest support.

AUDUSD bounces on improved risk appetite

The Australian dollar advances over a resurgence of risk sentiment. After the RBA held its official cash rate steady at 4.1% earlier this month, market participants are waiting to delve into the details leading up to the decision. With its kiwi neighbour also holding fire, one might start to believe the hard push in the southern hemisphere could be behind. If the upcoming unemployment figure shows some sort of loosening, that might further build the case for a milder approach by the central bank from here, which in turn would boost the appeal for the growth-sensitive aussie. 0.7000 is the next resistance and 0.6600 the closest support.

UKOIL recovers as demand pessimism fades

Brent crude claws back some losses as traders hope demand would recover later this year. Easing inflation in the US has fuelled speculations that the world is seeing through its most aggressive interest rate hike cycle over the past few decades. On the opposite side of the spectrum, further quantitative easing in China might be necessary to shore up momentum in post-pandemic recovery. Global economic headwinds have so far been limited and the International Energy Agency forecast that oil demand would hit a record high this year. An uptick in optimism could trigger short-covering towards 87.00 with 76.30 as fresh support.

SPX 500 advances on softer US inflation

The S&P 500 extends gains in the hope of an end to the tightening amid subsiding price pressures. Both producer and consumer data point to a slowdown in the inflationary trend, leading market participants to expect the 25bp rate increase by the Federal Reserve later this month to be the finale, which would mostly benefit growth-related stocks as the index recovers towards a 16-month high. Now that investors have their focus on the second-quarter US earnings season, decent results would smooth out the fear of uncertainty and compound an overall positive mood. The index is on its way to 4640 with 4330 as the first support.