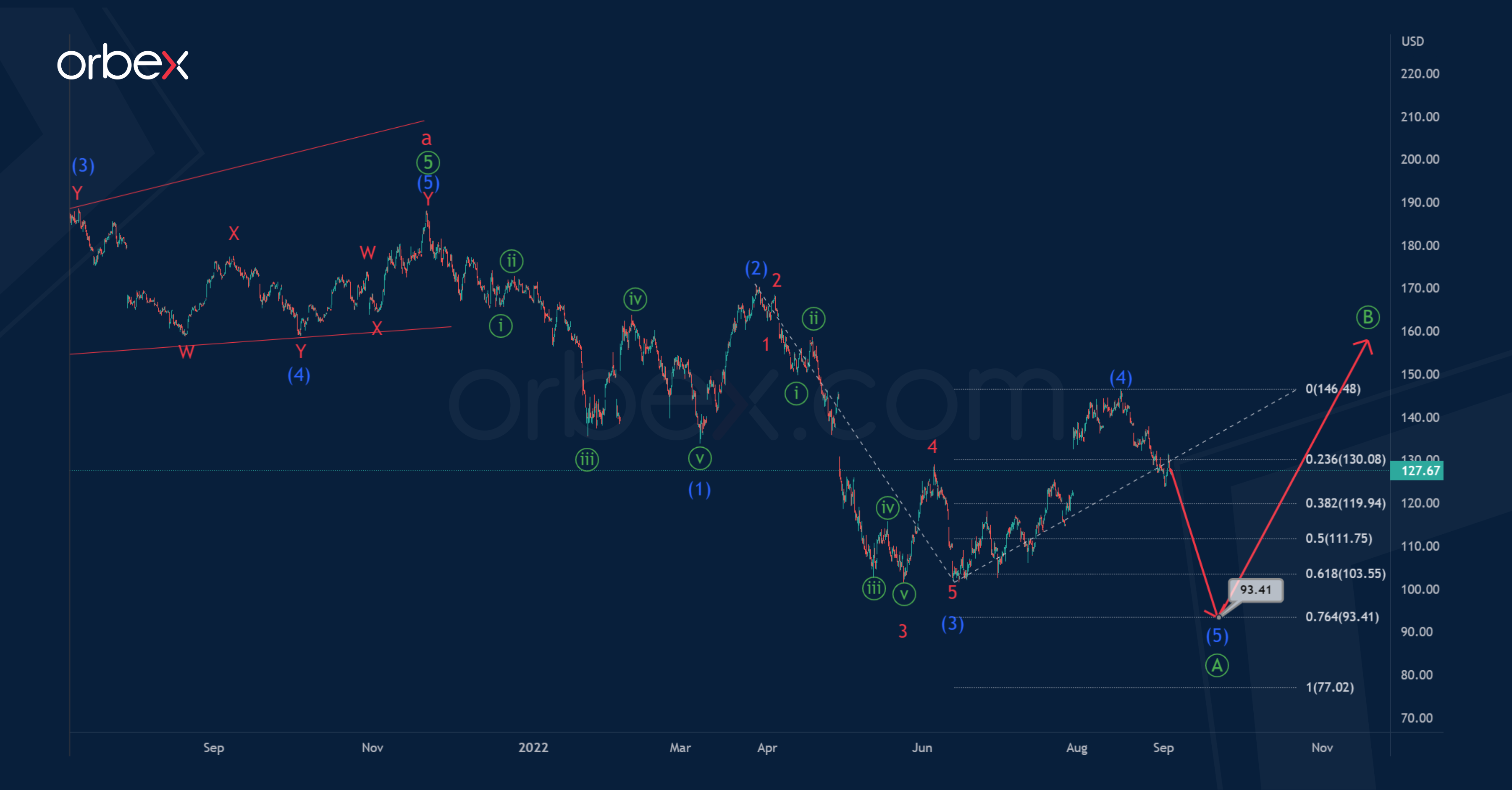

AMZN Leading Diagonal Begins Zigzag

AMZN shares are expected to develop a simple zigzag consisting of sub-waves a-b-c of the cycle degree. Perhaps the market has completed the formation of the first major wave a which was a bullish 5-wave impulse.

Since the end of last year, there has been a decline in the price, which could indicate the beginning of the construction of a bearish correction b. This correction could take the form of a zigzag Ⓐ-Ⓑ-Ⓒ.

Soon, we will see a decline in the final intermediate wave (5). This could end the primary impulse wave at 93.41. At that level, wave (5) will be at 76.4% of previous impulse (3).

After the end of the impulse wave Ⓐ, prices are likely to rise in the primary correction Ⓑ.

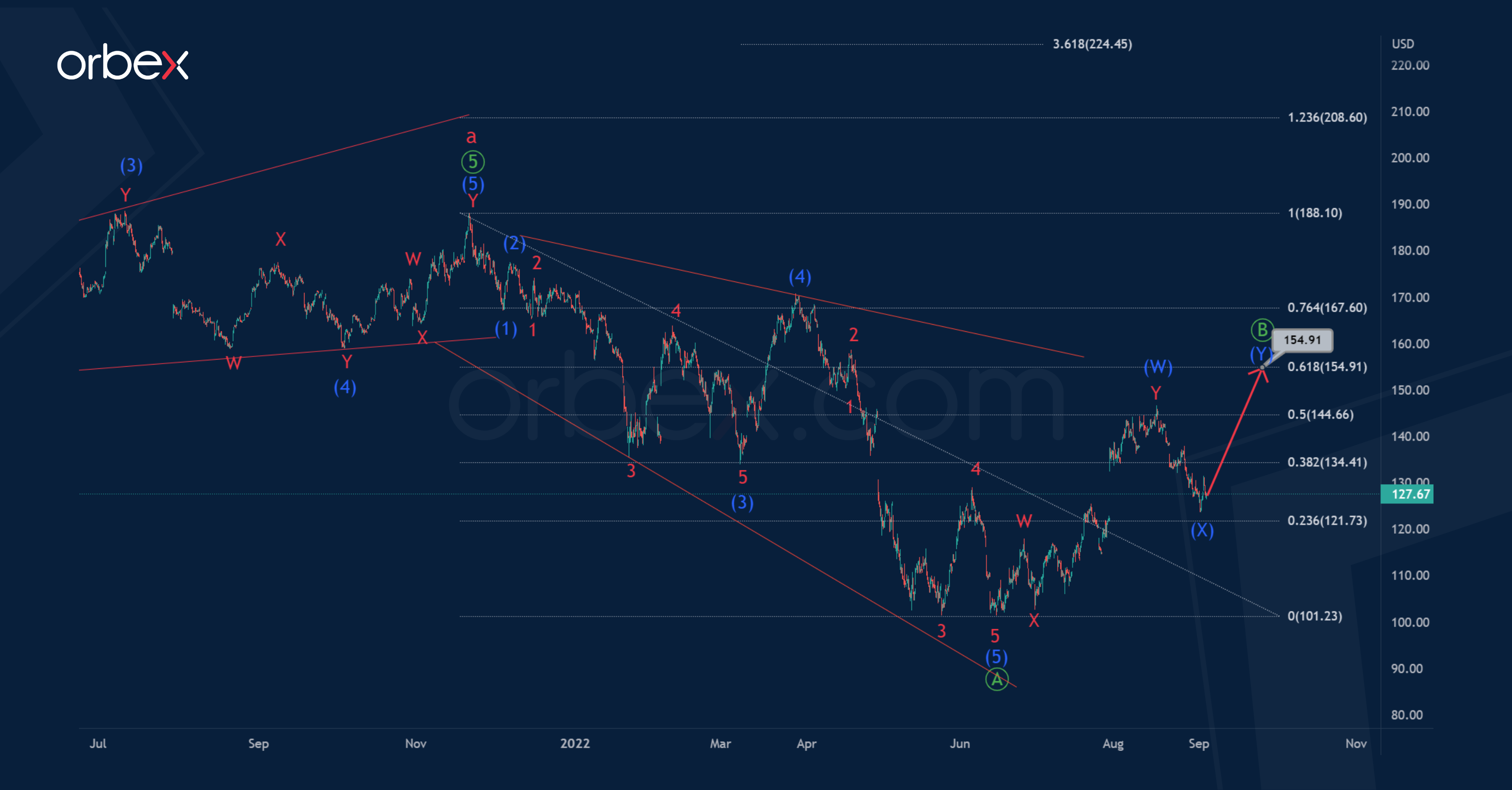

Let’s consider a scenario in which the market has completed the formation of the primary wave Ⓐ. According to this markup, the wave Ⓐ has the form of a leading diagonal (1)-(2)-(3)-(4)-(5).

In this case, in the last section of the chart, we see a price increase within the bullish correction Ⓑ.

It is assumed that the correction wave Ⓑ will take the form of an intermediate double zigzag (W)-(X)-(Y).

The correction could be at 61.8% of wave Ⓐ. Thus, its completion is likely to reach the level of 154.91.