GBPUSD 16-02-2018 Intra-day analysis

USD stays soft as market price in a March rate hike

Daily Forex Market Preview, 16/02/2018

The USD was seen trading weaker across the board on Thursday. The biggest gains came from the Japanese yen which surged 0.82% on the day.

Economic data from the U.S. was mixed. Producer price index data from the U.S. showed a 0.4% increase matching estimates and rising to an annual pace of 2.7%. Industrial production figures showed a 0.1% decline in January with previous month’s data being revised lower as well.

The capacity utilization rate slipped to 77.5%. The regional manufacturing index data showed that the Philly Fed manufacturing index rose to 25.8 beating estimates while the NY Fed manufacturing index eased from 17.7 in the previous month to 13.1 in February.

Looking ahead, the retail sales data from the UK is expected to show a 0.5% increase after falling 1.5% the month before. The data comes amid UK households facing faster inflation and slower wage growth. Data from the U.S. today will see the housing starts and building permits data coming out.

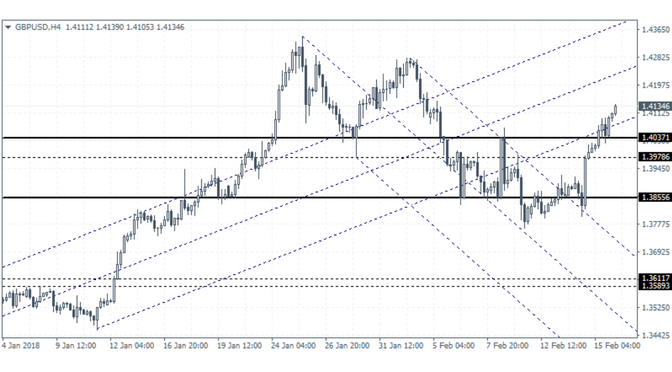

GBPUSD intra-day analysis

GBPUSD (1.4134): The British pound managed to push higher with price breaking out from the upside. The breakout from the resistance level at 1.4037 could indicate further upside gains in the currency pair. Watch for a short term correction towards 1.4037 for support to be established. This could potentially see further gains targeting the previous highs around 1.4279. To the downside, the declines will be limited to the support level but a break down below this level could keep GBPUSD range bound in the short term.