GBPUSD 08-02-2018 Intra-day analysis

EU gives upbeat forecasts. RBNZ keeps rates unchanged

Daily Forex Market Preview, 08/02/2018

The European Commission released its quarterly forecasts yesterday and gave an upbeat assessment to the growth in the Eurozone. Inflation and unemployment were however more subdued in comparison. The forecasts show that inflation in the Eurozone will stay below the ECB’s 2% target rate in 2019 at only 1.6%.

In the overnight trading session, the RBNZ voted to keep the overnight cash rate unchanged at 1.75%. The decision comes after a weak fourth quarter inflation data and a somewhat mixed unemployment numbers for the quarter.

Looking ahead, focus shifts to Threadneedle Street as the Bank of England will conclude its monetary policy with the statement and press conference. The BoE is expected to keep rates unchanged at today’s event. Economists are divided on whether the BoE will leave forward guidance unchanged or whether it will bring forward the rate hike expectations. The BoE is currently expected to leave rates unchanged at least until August this year.

Elsewhere, the weekly unemployment claims from the U.S. will be coming out later in the evening.

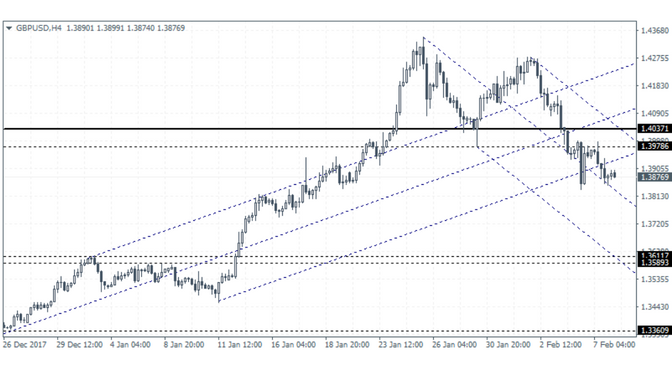

GBPUSD 08-02-2018 Intra-day analysis

GBPUSD (1.3876): The British pound has been extending declines over the past few daily sessions. Price action closed with an inside bar yesterday but further downside is expected. Following the breakdown below the support level at 1.4037, we expect to see a retracement to this level in the short term. If price action can establish resistance at this level, we could expect to see further declines pushing the GBPUSD down to the support at 1.3617 which is pending retest. To the upside, in the event that GBPUSD breaks past 1.4037, the downside bias is invalidated.