EURUSD 14-02-2018 Intra-day analysis

USD weakens as investors await inflation data

Daily Forex Market Preview, 14/02/2018

The U.S. dollar was seen falling against its peers on Tuesday amid a lack of any clear market catalysts. In the UK, data showed that consumer prices edged higher once again in January. Headline CPI was seen rising 3.0% on an annual basis while core CPI was also seen higher at 2.7%.

In Japan, the quarterly GDP data showed that the economy advanced only 0.1% on the quarter, missing estimates of a 0.2% increase. The previous quarter’s GDP was however revised higher to 0.6%.

Earlier in the day, New Zealand’s inflation expectations showed that inflation expectations were seen at 1.86% in one year and 2.1% in two years. The data gave a short term bump to the Kiwi dollar. The RBNZ had previously expected inflation to reach 2% band only around 2019. Looking ahead, the Eurozone quarterly GDP data will be coming out.

No changes are expected as the GDP is expected to remain steady at 0.6%. In the U.S. session, inflation data is expected to show a 0.3% increase on the month while core CPI is forecast to rise 0.2%. Retail sales figures will also be coming out at the same time.

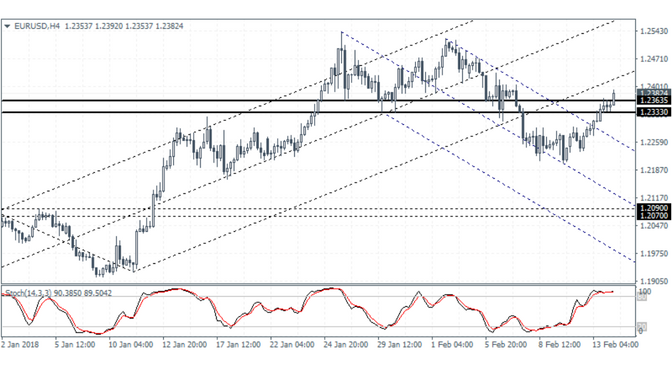

EURUSD intra-day analysis

EURUSD (1.2382): The U.S. dollar weakened which helped to keep the euro posting gains for two consecutive days. The EURUSD was seen advancing back to the resistance level of 1.2363 – 1.2333 level in the overnight trading session. A reversal at this resistance level could signal a near term dip with the potential for the common currency to advance the declines towards the 1.2090 – 1.2070 level of support to the downside. Alternately, if price action manages to break past the resistance level, we could expect to see a new leg to the rally. This will be validated on a breakout above the previous highs posted near 1.2500.