EURUSD 24-01-2018 Intra-day analysis

UK unemployment rate expected to remain at historic lows

Daily Forex Market Preview, 24/01/2018

The U.S. dollar was on the defensive yesterday as the currency posted some sharp intraday volatility as the funding bill was approved for a few weeks. The USD continues to remain weak against its peers. Lack of economic data also made investors look at the broader themes.

BoJ’s Kuroda held a press conference after the BoJ’s statement was released. Reiterating the BoJ’s commitment to its QE program, Kuroda quashed market expectations of a potential early exit to the central bank’s monetary stimulus program.

The euro and the British pound managed to flirt near the highs. Data from Germany showed an improvement in the German ZEW economic sentiment. The index beat market consensus of 17.8 as it rose to 20.4, accelerating from 17.4 previously.

Looking ahead, investors will be focusing on the flash manufacturing and services PMI from Germany, France and the Eurozone. The UK’s ONS will be releasing the monthly labor market statistics. The UK’s unemployment rate is expected to stay put at 4.3% while average earnings are expected to rise at a steady pace of 2.5%.

Later in the evening, New Zealand will be reporting on its quarterly CPI figures. Economists have penciled a slower rate of inflation growth at 0.4% for the fourth quarter of 2017.

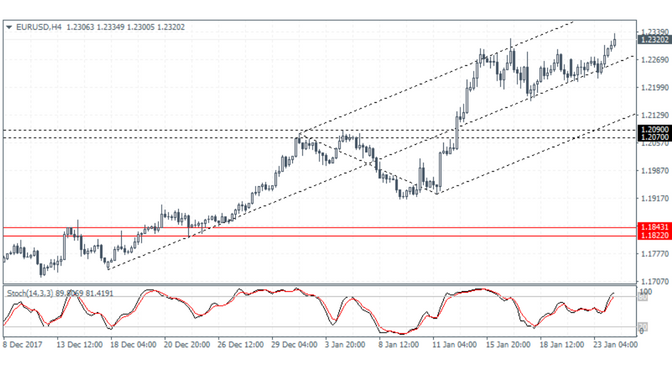

EURUSD 24-01-2018 Intra-day analysis

EURUSD (1.2320): The euro currency was seen turning bullish yesterday with price action seen extending the gains in the early Asian trading session today. The euro’s gains came broadly from the USD’s weakness. EURUSD managed to edge slightly higher trading near the 1.2300 handle. However, the current higher high posted is seen with the Stochastics oscillator forming a lower high. The divergence could potentially indicate a downside move in the euro. Price action is trading near the major resistance level of 1.2300 region. Unless there is a strong close above this level we expect to see the potential for a correction in the common currency.