BOC Decision & FOMC Meeting Minutes Ahead

Despite the recent developments in Europe, especially in the UK, Manchester attack, and raising the level of security in the UK, markets have been trading with low volume.

Moreover, the European session today was quiet amid a lack of fundamentals across Europe, despite the fact that the German Consumer Confidence release, which posted the highest level since 2011.

Yet, the market kept on trading within a tight range and low volume until this report was released.

During the US session ahead, there are some economic releases and events, which may finally lead volatility to pick up notably.

Bank of Canada Rate Decision

At the beginning of the US session today, all eyes will be on the Bank of Canada rate decision at 14:00 GMT+, which likely to have a notable impact on CAD pairs.

The estimates point to no change. The Bank of Canada is expected to keep the overnight rate on hold at 0.5%.

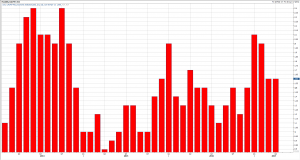

Canada’s inflation rate has picked up since the beginning of the year, just like the rest of the world, the YoY CPI advanced to 2.1% in December of last year, after it was below 1.1% in Mid-2016.

At the same time, inflation has slowed down a little bit back to 1.6% for the past two months.

On the other hand, growth also picked up, the MoM GDP posted the longest growth stake since 2013, posting seven months of consecutive gains.

So far, there is no reason for the Bank of Canada to change the current policy, even with rising inflation, as housing sector is somehow overheated.

CAD Outlook

A few weeks ago, USDCAD posted the highest level since almost a year, rising to 1.38, before retreating to 1.35 until this report is released.

One of the reasons for such rally is due to Crude Oil prices, which had a rough journey for the past two months.

In the meantime, USDCAD tested its 50 DAY MA during yesterday’s trading for the first time in one month, closing yesterday’s trading with a bullish shooting star on the daily chart, which would be a sign for another bull run ahead.

Technical indicators are also oversold and crossed over to the upside. However, since Crude Oil is the biggest influence on CAD, traders should keep an eye on OPEC meetings in the coming days.

So far, even if OPEC managed to extend the current deal, most of the decision is already priced in, meaning that Crude might be on the edge of another leg lower. In return, this would keep the pressure on CAD. As long as USDCAD stays above 1.34, the possibility to retest 1.38 is here to stay.

FOMC Meeting Minutes Ahead

After NYSE lunch time today, eyes will turn toward the Federal Reserve, as we wait for the FOMC Meeting Minutes.

Today’s statement should give us some clues about the coming meeting in June, whether there is still a possibility to raise the Fed Fund Rate by another 25bps.

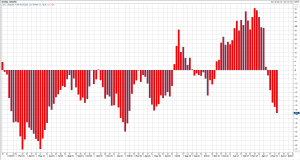

However, looking at the Citi Surprise Index for the US, it tumbled back to the lowest level since June of last year, as the economic activities in the US have slowed down notably over the past few weeks.

The Fed might also keep the tone unchanged today. However, the market understands that today’s meeting minutes are actually expired, and were written before the recent slowing down.

Therefore, if the Fed surprised the markets with a dovish tone, this would push the US Dollar sharply lower across the board.

On the other hand, a balanced statement would mean that today’s FOMC Meeting Minutes will be a non-event.

![Credit Card 160×600 [EN]](https://assets.iorbex.com/blog/wp-content/uploads/2023/06/13144507/Blog-Banner_EN-Banner_160X600X2.webp)