Aussie gains on better than expected jobs report

The Australian dollar, which opened mixed this week was seen making gains led by a better than expected jobs report. Data for the month of December showed the unemployment change beating estimates rising 37.4k vs. 5.3k consensus while data for the previous month was revised upwards to 45k.

The unemployment rate improved to 6.1% in December, while data for November was revised to 6.2%, from 6.3% previously. The combined data posts one of the fastest pace of job growth in nearly 8 years. Across all subsectors, the numbers showed a marked improvement especially with the participation rate showing moderate, but consistent gains, rising to 64.8%.

There were not much of economic releases from Australia this week with the exception of the home loans which declined -0.7% for the month. The Aussie dollar however largely ignored the numbers.

The improvement in the jobless rate has made analysts question the speculation of a rate cut from the RBA this year which as it stands is expected to cut rates by as much as 50bps. The RBA’s overnight cash rate currently stands at 2.5% but is pressured to cut rates due to the slow recovery in the mining sector as well as softer than expected GDP growth.

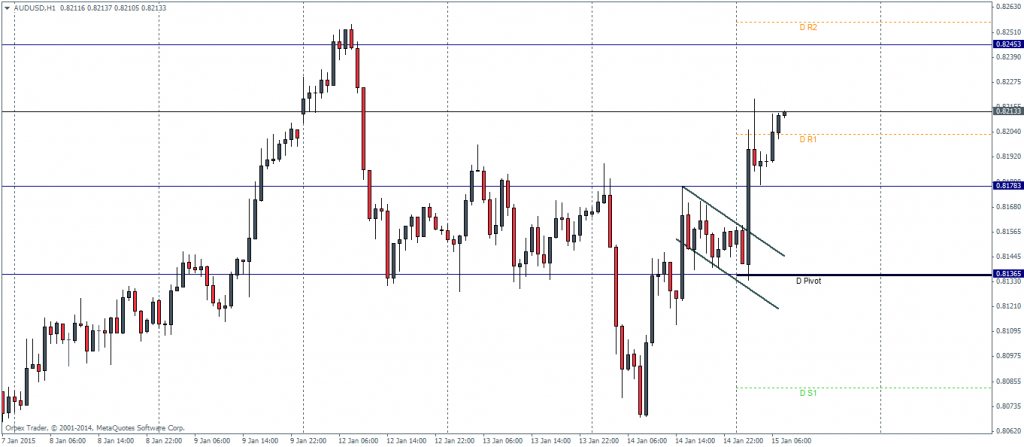

AUDUSD – Technical Outlook

AUDUSD which managed to turnaround higher yesterday after the broad-based declines in commodities, mostly Copper continued to build momentum against a weaker Greenback which saw a reactionary sell off yesterday after retail sales disappointed.

The Aussie managed to find a base near the lows of $0.806 levels since yesterday and was seen currency trading at $0.82. Further upside gains are likely as price action on the hourly charts show a breakout led by the jobs report. The eventual target is likely to move to as high as 0.8245 levels.

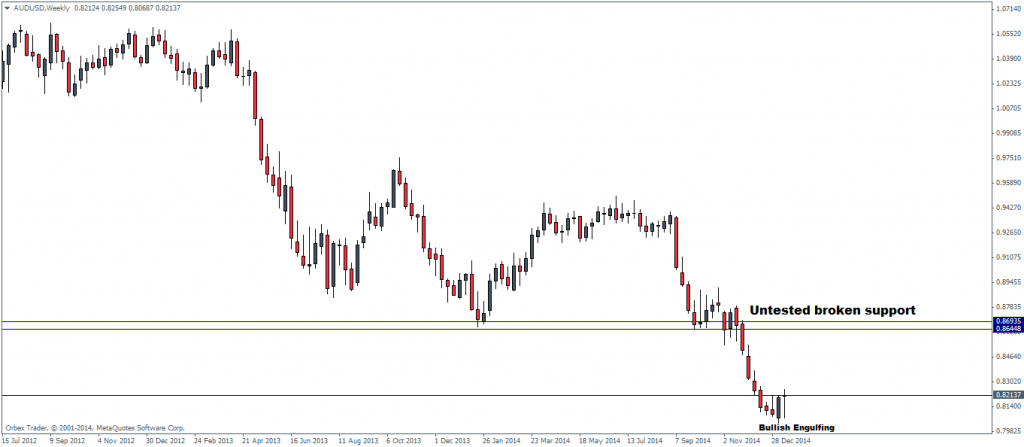

From the weekly charts, we notice that last week’s candle posed a bullish engulfing pattern in terms of the open and close. We would however need to see a higher close from 0.8215 in order to confirm the turn of short term bias from bearish to bullish. The longer term broken support near 0.864 is something that will be tested for resistance at some point.

The main risks for the Aussie comes from tomorrow’s US CPI numbers, which currently is expected to be lower. A worse than expected CPI would definitely see some profit taking in the Greenback, which could result in a short term weakness in the US Dollar.

There is no scheduled RBA monetary policy meeting this month, but do look out for quarterly CPI numbers for the 4th quarter of 2014, due to be released towards end of January. Considering the global decline in inflation, we could possibly expect to see a downward reading. Quarterly CPI at this point stands at 0.5% for Australia. Another major factor worth keeping in mind is any verbal interventions from the RBA officials, known for talking down the Aussie as it starts to climb above $0.82.

![Credit Card 160×600 [EN]](https://assets.iorbex.com/blog/wp-content/uploads/2023/06/13144507/Blog-Banner_EN-Banner_160X600X2.webp)