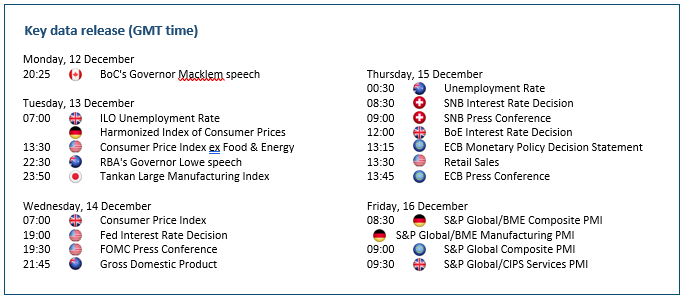

The Week Ahead – Heavyweight data and central bank decisions before year’s end

EURUSD awaits double catalyst

The euro consolidates as both central banks will fire their last salvos of the year. Inflation expectations remain high in the eurozone and bolster the likelihood of a 50 bp hike by the ECB. But market dynamics are driven by the greenback. Despite the euphoria from Powell’s hint of slower tightening, robust jobs and services data have sowed doubt about the terminal rate, which may end up above 5% if the Fed vows to keep interest rates restrictive for a prolonged period of time. Only a soft US CPI reading could keep the pivot hope alive and by extension the dollar in check. 1.0900 is the hurdle ahead and 1.0300 the first support.

GBPUSD braces for volatile week

The pound steadies ahead of key economic data and the BoE’s policy meeting. Sterling continues to recover after the previous administration’s mini-budget fiasco, which suggests that traders have regained faith in the UK’s policymaking. Both employment and inflation could build up volatility leading up to the BoE rate decision on Thursday. Governor Andrew Bailey has been striving to balance market expectations by saying that the peak rate could be less than currently priced in. The market is betting on a 50 bp rate rise, but a dovish forward guidance could weigh on the currency. 1.1900 is the first support and 1.2660 the next stop.

UKOIL falls as demand outlook worsens

Oil prices slump over growing recession concerns. As the price cap on Russian crude may have marginal impact on production, traders have shifted their attention to the demand side. The prospect of more interest rate hikes is a reminder that the world has entered a cyclical downturn. In China, despite relaxed restrictions, surging infections could hamper economic activities in the coming months as the country learns to live with the virus. The market mood is extremely pessimistic as even the gradual reopening has failed to support the price. Brent crude is reaching a 12-month low at 70.00, and 87.00 is the closest resistance.

NAS 100 hesitates over policy uncertainty

The Nasdaq 100 softens as the Fed policy remains uncertain. Investors struggle to grasp a clear direction as strong US economic data contradict the Fed’s moderate tone. The market is also contemplating the possibility and timing of a downturn as a steep rise in borrowing costs stretches corporate America, and growth sectors in particular. Inverted yield curve, a market indicator of a looming recession may keep investors on their toes. Blue chip indices S&P 500 and Dow Jones 30 have outperformed the Nasdaq in the recent rebound, a sign that risk appetite is still lacking. 12800 is the first hurdle and 10600 a critical support.