Intraday Analysis 24.05.2023

Gold tries to bounce

USDCHF bounces back

The US dollar finds support from recovering Treasury yields in the wake of hawkish Fed comments lately. Having seemingly bottomed out near January 2021’s lows at 0.8820, the pair could start to recover some lost ground. 0.8960 is the latest support and a bullish MA cross on the daily chart is an encouraging sign and could attract market participants who dread missing the rebound. After clearing the psychological level of 0.9000, 0.9060 would be the next hurdle where a subsequent breakout would lead to a runaway rally.

EURGBP struggles to bounce

The euro softened after May’s manufacturing PMI showed signs of easing across the bloc. The bulls have been trying to hold against the bears’ repeated attempts to push below 0.8660. A breakout would expose last December’s lows around 0.8560. 0.8720 on the 20-day SMA is a major ceiling and a shooting star in this supply zone indicates a lingering selling pressure. An invalidation of 0.8690 has forced short-term buyers to bail out and put sellers back on the driver’s seat instead, turning the level into a fresh resistance.

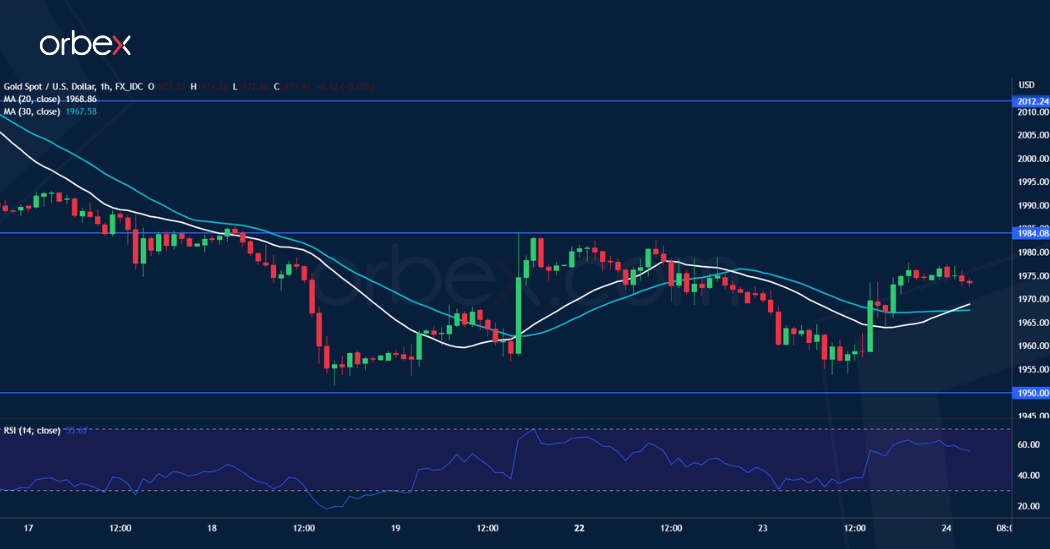

XAUUSD tests resistance

Gold rebounds amid a lack of breakthrough in the latest US debt ceiling talks. A fall below the daily support of 1980 has dented the bullish mood, prompting buyers to trim their exposure in fear of a deeper pullback. A bearish MA cross on the daily chart combined with a faded rebound at the demand-turned-supply zone around 1984 suggests that the path of least resistance could be down. A drop below 1950 would renew the selling pressure and make 1920 the next stop. 2012 is the ceiling to lift before the rally could resume.