Intraday Market Analysis 27.09.2022

GBP probes resistance

GBPUSD finds limited relief

The pound recoups losses over speculations of an emergency rate hike by the BoE. After breaking below March 2020’s lows near 1.1500 Sterling sank to an all-time low at 1.0350. An extremely oversold RSI on the daily chart prompted intraday traders to take some chips off the table. However, strong selling pressure could be expected from trend followers as the pound probes resistance overhead. 1.1050 would be the first hurdle and 1.1350 over the 20-hour moving average a major level that may keep the bounce in check.

NZDUSD remains under pressure

The New Zealand dollar softens as markets remain gripped by growth fears. The fall accelerated following the kiwi’s failure to bounce at May 2020’s low (0.5930). The bearish inertia and pessimism may continue to drive the price south. The RSI’s oversold condition could trigger sporadic bounces. 0.5740 is a resistance where the bears could be eager to sell into strength. A struggle to break higher would show a lack of sustained buying interest and the pair may drift towards 0.5600 and then March 2020’s lows around 0.5500.

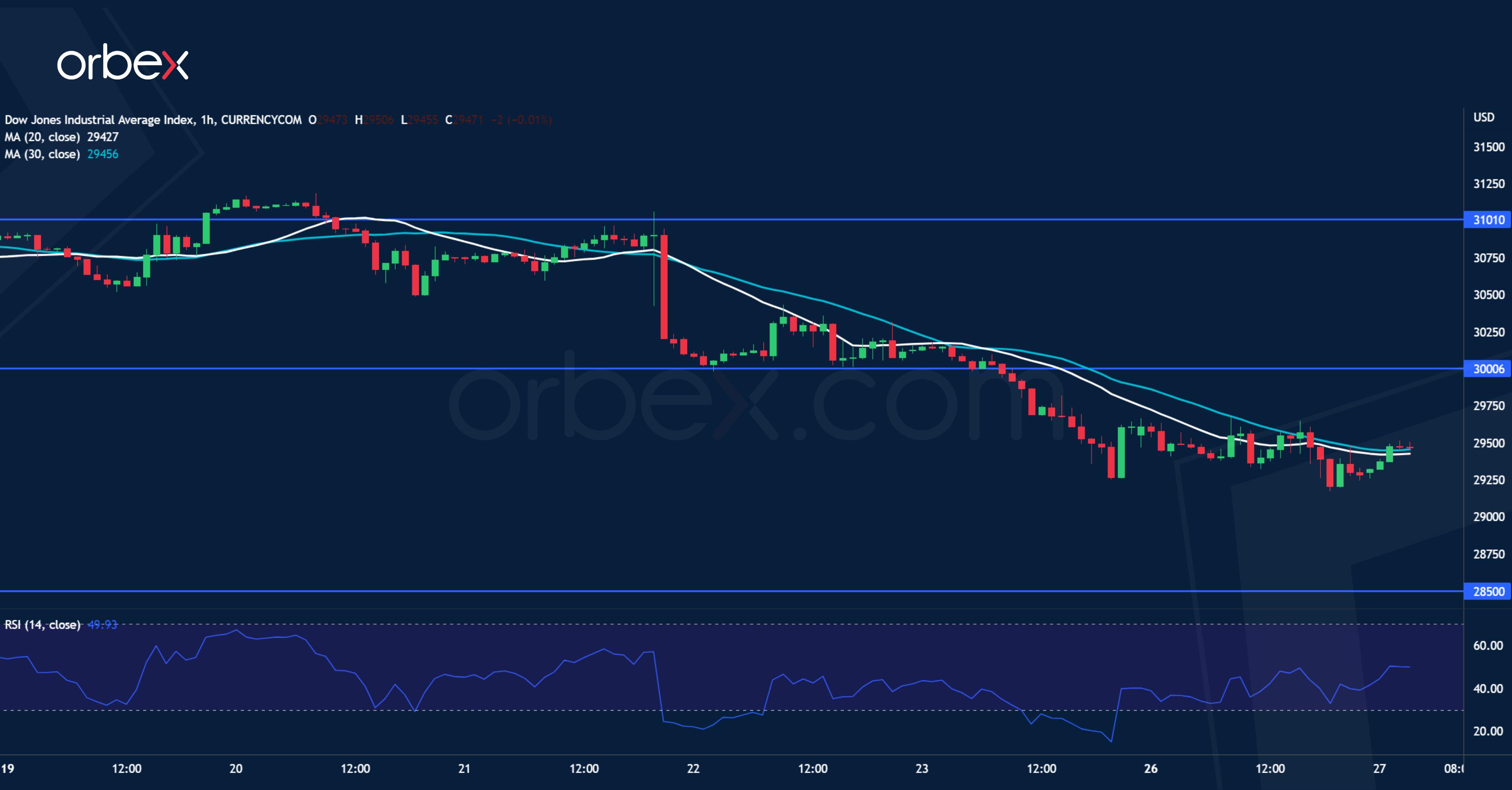

US 30 breaks critical floor

The Dow Jones 30 slips over concerns of a Fed tightening overdose. A break below June’s low at 29800 may have sealed the fate of the index by putting it on a bearish track. The breakout also confirms the bearish MA cross on the daily chart, indicating an acceleration to the downside. 28500 could be the next target. A brief bounce may draw more selling interests as the downtrend resumes its course, while trapped bulls may seek to bail out in the supply zone near the psychological level of 30000, exacerbating volatility in the process.

![Credit Card 160×600 [EN]](https://assets.iorbex.com/blog/wp-content/uploads/2023/06/13144507/Blog-Banner_EN-Banner_160X600X2.webp)